The Of Summitpath Llp

The Of Summitpath Llp

Blog Article

Not known Facts About Summitpath Llp

Table of ContentsThe Buzz on Summitpath LlpThe Single Strategy To Use For Summitpath LlpA Biased View of Summitpath Llp9 Simple Techniques For Summitpath Llp

Most lately, launched the CAS 2.0 Method Development Coaching Program. https://freeseolink.org/SummitPath-LLP_379417.html. The multi-step mentoring program includes: Pre-coaching placement Interactive group sessions Roundtable discussions Individualized mentoring Action-oriented mini intends Firms aiming to expand right into advisory services can also turn to Thomson Reuters Method Onward. This market-proven methodology uses web content, devices, and guidance for firms thinking about advising servicesWhile the modifications have actually opened a number of development possibilities, they have actually also resulted in difficulties and concerns that today's companies require to carry their radars. While there's variation from firm-to-firm, there is a string of usual challenges and concerns that often tend to run sector vast. These consist of, but are not limited to: To stay competitive in today's ever-changing governing atmosphere, companies have to have the capability to swiftly and successfully perform tax obligation study and improve tax reporting efficiencies.

Additionally, the brand-new disclosures may lead to a boost in non-GAAP actions, historically a matter that is extremely looked at by the SEC." Accountants have a great deal on their plate from governing changes, to reimagined organization models, to a boost in client expectations. Equaling everything can be tough, but it doesn't have to be.

Examine This Report about Summitpath Llp

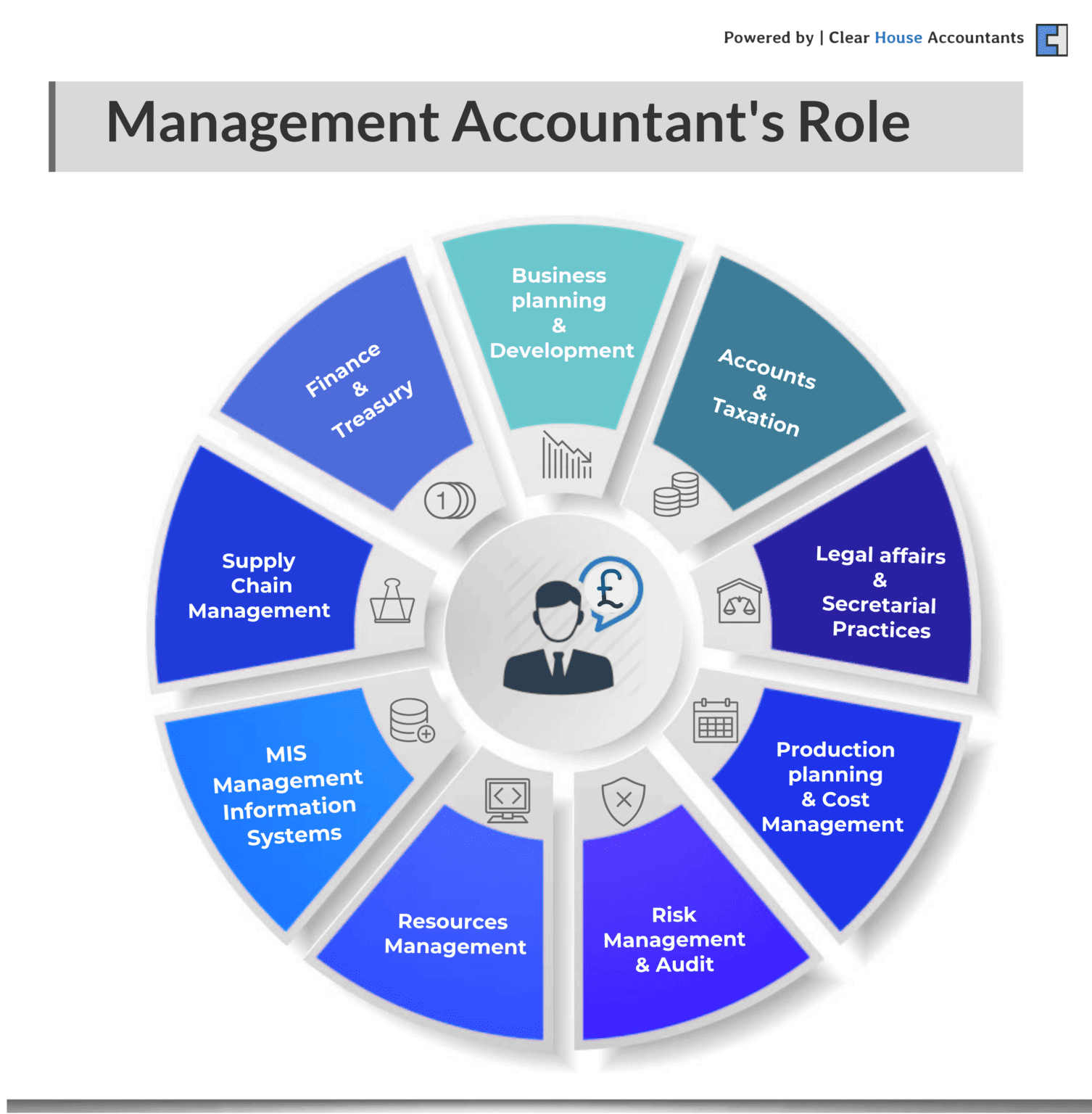

Listed below, we describe four certified public accountant specialties: taxation, administration audit, monetary coverage, and forensic audit. CPAs focusing on tax aid their clients prepare and file tax returns, minimize their tax problem, and stay clear of making blunders that can lead to costly penalties. All CPAs need some understanding of tax regulation, yet specializing in taxes means this will be the focus of your job.

Forensic accounting professionals generally start as general accountants and relocate right into forensic accountancy functions over time. They require solid analytical, investigative, business, and technological bookkeeping skills. Certified public accountants that focus on forensic bookkeeping can often move up into management audit. Certified public accountants need a minimum of a bachelor's degree in accounting or a comparable area, and they should complete 150 credit history hours, including accounting and business courses.

No states call for read an academic degree in accounting. An accountancy master's degree can assist students fulfill the CPA education requirement of 150 debts given that the majority of bachelor's programs just call for 120 credits. Accountancy coursework covers topics like financing - https://www.smugglers-alfriston.co.uk/profile/josehalley1817257/profile, auditing, and taxes. As of October 2024, Payscale records that the typical annual income for a certified public accountant is $79,080. Calgary Bookkeeping firm.

Accountancy additionally makes functional feeling to me; it's not simply academic. The Certified public accountant is a crucial credential to me, and I still obtain continuing education and learning credits every year to keep up with our state demands.

Summitpath Llp Can Be Fun For Anyone

As an independent professional, I still make use of all the fundamental structure blocks of accountancy that I learned in college, pursuing my CPA, and operating in public bookkeeping. One of the important things I truly like regarding accounting is that there are several tasks available. I determined that I wanted to begin my occupation in public bookkeeping in order to find out a lot in a brief period of time and be revealed to different types of customers and various areas of bookkeeping.

"There are some workplaces that don't want to take into consideration a person for a bookkeeping role who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CPA A CPA is a very useful credential, and I desired to place myself well in the market for different work - CPA for small business. I decided in college as an audit major that I desired to attempt to obtain my certified public accountant as quickly as I could

I've met plenty of excellent accountants that do not have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential really helps to advertise your know-how and makes a distinction in your settlement and career choices. There are some workplaces that don't want to take into consideration a person for an audit function who is not a CERTIFIED PUBLIC ACCOUNTANT.

Summitpath Llp - An Overview

I truly enjoyed working on different kinds of projects with different clients. In 2021, I determined to take the next action in my bookkeeping profession trip, and I am currently an independent accounting professional and organization advisor.

It remains to be a development location for me. One vital quality in being a successful CPA is truly caring about your customers and their companies. I like collaborating with not-for-profit customers for that extremely factor I feel like I'm actually adding to their goal by assisting them have good economic info on which to make wise company decisions.

Report this page